Over the course of this year, I’ve written a couple times about raising a potential round of venture financing for my company, SEOmoz. At last, the saga’s over, I’ve been released from terms of confidentiality and I can share the long, strange story of how I first rejected, was eventually persuaded, but ultimately failed to raise a second round of investment capital.

My hope is that by sharing, others can learn from our experience and possibly avoid some of the mistakes, pitfalls and pain we faced.

Raising money for a startup is an inherently risky proposition. You step up to the plate knowing that the odds are slim and that, for every story of success on TechCrunch, there’s two hundred companies pounding the street, getting nowhere. We went the opposite route – letting investors come to us (a strategy I wrote about last year). This is the story of that experience – being “pitched” by investors, the decision-making and negotiation processes and the end results.

Do We Really Want to Raise a Round?

In November of last year, 14 months after my previous failed attempt to raise capital, we started receiving inquiries from a variety of firms – venture capitalists and private/growth equity investors, asking if SEOmoz was interested in pursuing funding. My answer was always the same, and looked fairly similar to the email below:

Over the following months (Nov 2010 – April 2011) we hunkered down, focused on product, technology and marketing and grew the business, largely ignoring the possibility of outside funding.

In March of 2011, one particular investor (whom I’ll refer to through the rest of this post as “Neil”) reached out to us and was especially excited about the SEO/inbound marketing sector and SEOmoz in particular. He sent this email after our call:

It was flattering and exciting to feel this great level of interest in our business from an investor, and Neil wasn’t the only one, either. Here’s a list of the folks we talked to seriously (meaning more than just a single phone call or email) over the first 7 months of 2011:

• Bessemer Venture Partners

• GRP Partners

• Stripes Group

• Insight Ventures

• JMI Equity

• Level Equity

• Mayfield Capital

• Accel Partners

• Summit Partners

• NEA

• General Catalyst

• K1

• Industry Ventures

For the firms noted above, I’ll keep specifics of who we spoke to and how far we progressed private (as I did in my post on the 2009 experience) using pseudonyms.

The week of May 8th, I met with 3 investors in New York City and one in Boston. In preparation for these meetings, I tried to remind myself that money might not be the best thing for the company with a public blog post on the topic. I was focused on the goals of building relationships, sharing our trajectory and learning as much as possible about how others viewed our business and market.

Despite this bevvy of interest, my previous fundraising experience had left me gun-shy and reticent about committing. A week after the meetings in NYC, the Moz team had a serious chat about whether raising a round could have a serious, positive impact on the company. That discussion included a lot of back-and-forth, but the reasons we ultimately decided to test the waters more seriously included:

• Grow Engineering – For the first quarter of 2010, we had a mandate to grow the engineering team so we could improve our product faster. This proved incredibly difficult, as the much-reported tech talent wars in Seattle created a vacuum of big-data savvy SDEs. However, in Q2, our position shifted as we were able to significantly grow the engineering team – to a point where we had to slow hiring in order to keep payroll in line with our bootstrapped growth. While certainly a positive, this change meant that we were limited by cash in the bank for the first time in a while.

• Scale Data – Linkscape, Blogscape and our APIs cost ~$100K/month at the beginning of the year. In Q2, this cost had risen 30%+ and we foresaw a nearby time when it would double or more. In July of this year, those costs were, indeed, nearly $200K. We’ve gone from 40 virtual machines hosted on Amazon to 200+, and while we’re thrilled to see our metrics (mozRank, Domain Authority, et al) achieve widespread adoption, many of the heavy users employ our free API, leaving our revenue from other channels to support these costs. Long-term, we believe in free, open data as a way to grow the brand, the company and our revenue-producing channels (and it’s part of our core values to be as open and generous as possible with our data), but the cash limitations had finally become a point of frustration, and another reason to seek growth capital.

• Expand Facilities/Benefits/Team Happiness – The Moz offices can comfortably hold 45-50 people, but we realized that by Q3, we’d already be at that range. We also recognized that the aforementioned talent wars were pushing us to grow the range of benefits and space we provide to the team. Moz was named #6 on Seattle’s Best Places to Work, but we’re striving for #1, and we strongly believe that the better we can treat our team, the more amazing our output and results will be.

• Release New Products – Our big data projects have been challenging, but also incredibly rewarding, and we felt a strong drive to do more, faster. We want to produce marketing analytics beyond pure SEO, moving to field like social, content marketing, local and verticals (mobile, video, blogs, etc. – anything that sends traffic on the web organically). Some of those require heavy upfront investments in data sources, engineering and market research. One of the weird things I’ve found (which probably deserves a post of its own at some point) is that the larger your scale, the longer it takes to build product. You’d think that having 15 full-time engineers and a significant support team around them would mean faster development, but it doesn’t – the scale we need to support (nearly 14K paying customers and 250K+ users of our free products) for anything we release means far greater attention to architecture, reliability and quality then when we had two devs and 500 users.

• Invest in Marketing – Today, most of SEOmoz’s acquisition of new customers is through inbound/organic channels (~80%). We recognize there’s a lot of room for growth in both organic (content marketing, more community investment, SEO, social, etc) and in paid marketing. An investment here would allow us to take a longer view on customer payback period (the time until we recoup an investment in acquisition) and experiment in new channels, too.

• Provide Liquidity to Founders – Gillian founded the company that would become SEOmoz in 1981 and I’ve been working with her since 2001. As Gillian’s stepped aside from day-to-day responsibilities (post 2008) and taken on more of an external evangelism role, we all felt that giving her a more formal exit and liquidation path would be an ideal option. I also personally felt it was wise to take some money off the table.

I’d be remiss if I didn’t also mention another meeting in Boston – with Hubspot’s Dharmesh Shah. For the past few years, Dharmesh has been an amazing mentor to me, and someone whom I always turn to when big decisions like this appear. On the topic of funding, he gave clear, well-reasoned advice (and later, made that advice public). We met in May, just after my in-person meetings in New York, and noted that the combination of a great market for investment plus strong growth at the company made for excellent fundraising conditions.

Testing the Waters for a Large Financing Round…

Thus, in mid-May, when Neil asked to follow up with an in-person visit to our offices in Seattle, I sent the following email reply:

After that meeting in Seattle, things got hot and heavy. Neil wanted to do a deal and we began talking terms. It was at this point that our executive team and board of directors decided to take some steps to insure that we were making the right moves. These included:

• Meeting with and, hopefully, receiving offers from 2-3 of the other firms who had reached out to Moz to help test the waters on valuation and deal terms, and to make sure we had a partner and investor we loved.

• Deep-diving on Neil and his firm. We ended up speaking directly to folks at 2 of their portfolio companies, several people who worked with Neil in his previous roles and back-channeling to nearly half a dozen others who’d worked with him in one way or another through our network of contacts (both at Moz, and through Ignition Partners, our investors from 2007).

• Working hard on long-term, strategic planning for 2012 and beyond – what did we want to do, how much would it take, and where would the money be spent?

• Preparing a semi-formal slide deck to pitch the partnership at Ignition, as we wanted them to participate in the round as well. We also made a light version of this deck to send around to several folks in the field and help drum up any potential interest without being too forward or pushy.

• Investigating the fundraising market for self-service SaaS companies like ours by talking to as many recently funded entrepreneurs in the space as possible. Through this research, we hoped to get a good idea of what sorts of terms and valuation we should expect, and what was “market” (VC-speak for “normal”).

In mid-June, I made a trip to San Francisco, ostensibly to participate in SimplyHired’s SEO Meetup, but also for several Bay-Area meetings with VCs. Three of these turned into more serious discussions.

June was also when we started to feel a bit cocky. We were in active negotiations with Neil. We had multiple talks going with investors in the Bay Area, and almost every week, we had a ping from a new source reaching out to see if we were ready to start a conversation. I spoke to dozens of folks by phone and email and learned a lot more about the market – and those conversations gave me a lot of reasons to get excited. As in 2007, a lot of startups were reporting a very hot market for raising money. Valuations of several SaaS businesses I talked with were in the 6-10X revenue range (and those who raised in Q1/Q2 got valued on their 2011 estimated revenues)!

Narrowing Down the Field

Throughout the process, we’d been extra careful on the investors we engaged. We turned away one firm due to a bad experience we had with them in 2009 (email below).

This example wasn’t alone – we turned away another after talking to some of their portfolio companies and a company they’d look at but didn’t invest in and hearing about some questionable behavior.

Our biggest filter wasn’t deal terms or price, but cultural fit. We’d been warned many times against adding an investor who didn’t share our core values or who displayed any dishonest/manipulative tactics in our conversations. That ruled out a few folks, but also made us more excited about Neil, “Reggie” (an investor in California) and “Todd” (at another California-based firm).

One of my favorite emails in our process came from Reggie, who sent this just before their in-person visit to the Mozplex:

Adorable, right?! Sometimes, it’s the little stuff. Neil always asked about my grandmother in New Jersey (she had a rough fall, a concussion and spent a few weeks in hospitals, but is now nearly 100% and doing well). Todd wolfed down multiple helpings of phenomenal braised pork shoulder made by our systems engineer, David. Sarah and I dragged both Neil and Reggie to meals with both of our significant others.

But, the fundraising process certainly wasn’t all fun, and it did require a tremendous amount of work, particularly from Sarah, Moz’s COO, and from Jamie + Joanna on our marketing team, who held numerous calls with investors on a ton of membership acquisition/retention-related topics. Here’s a brief snippet of a weekend email thread that Sarah sent to Todd:

In June and July, the funding process probably entailed hundreds of combined hours of work on the part of our team – much of that was me, but plenty spread to other departments and functions. We knew this was a very big decision – one that would massively impact the future of the company – and thus, we wanted to be as diligent, thoughtful and cautious as possible.

By early July, we were down to four potentially serious investors. One decided against making an offer around the middle of the month. The others were Neil (from NY), Reggie (from CA) and Todd (also CA).

Closing the Deal

At the beginning of July, one of the investors made an offer at a $50mm pre-money valuation for a $25mm investment. Here’s my email reply:

That offer was subsequently raised to $65mm pre-money, which was matched by another firm (both Neil + Reggie). I was feeling pretty good about my negotiation skills, until a couple weeks later.

Todd was an early favorite of several Mozzers. At the end of his visit to our offices, I gave him a ride back to the airport (I borrowed Geraldine‘s only-slightly-dented 2003 Kia Spectra, since I don’t actually own a car). Near the end of the conversation, Todd noted that his firm “would have a tough time getting to $100mm” on our deal. I probably should have corrected him at that point (it would have been the TAGFEE thing to do), but I instead said something like “this isn’t entirely about the highest pre-money valuation; it’s about the right fit for us.” This would serve as a good example of why I shouldn’t try to “play the game.” A week later, after lots of back-and-forth, Todd noted that his firm simply couldn’t match our valuation expectations, and although interested, would be backing out.

I’m not sure if our strategy with Todd was a big misstep or a small one, nor whether they would have made an offer in the $60-$70mm range if they’d thought that was our target. I also don’t know why he thought we were offered those much higher numbers, nor what we should have done from there. We could have gone back and pushed on what they thought we wanted, but it seemed the time had passed (hard to describe why/how exactly).

We made our decision, sent a polite note to Reggie thanking him and another to Neil saying we were ready to move.

Pitching Ignition Partners

In addition to raising funds from an outside partner, we also wanted Ignition, who had put $1mm into the company in 2007 to participate in this next round. Their support would be helpful in making outside investors feel great about the deal, and would help us have more shared ownership among our board members.

Below is the pitch deck I used for Ignition (parts of this made it into the “light” version we sent to some other folks earlier in the process):

We’ve had a terrific relationship with Ignition over the years, and I continue to recommend them to startups of all kinds. As part of the “thank-you” for their support, Geraldine baked some cookie bars the night before our pitch meeting, which I brought to their offices and handed out prior to the presentation. I took a photo hoping that I’d be able to share it on the blog once the deal was done:

Note the delicious-looking baked goods on the table

Note the delicious-looking baked goods on the table

Ignition confirmed, just after this meeting, that they’d love to participate in our next round, in whatever quantity made sense to the outside, lead investor. We were excited, and spent some serious time in July planning a comprehensive strategy around how to grow with the funding. We even started some conversations with other companies we were considering acquiring.

Neil brought several folks from his firm to our annual Mozcon in Seattle. On the last afternoon, we met to negotiate some final terms of the deal. It ended up looking like this:

• $24mm invested; $19mm from Neil and $5mm from Ignition

• $65mm pre-money valuation, $89mm post

• $18mm to SEOmoz’s balance sheet; $4.75mm to Gillian, $1.25mm to Rand

• No liquidation preference for Series B (Ignition has a 1X on the Series A)

• Straight preferred (meaning that the investor either gets their money out in a sale OR the percent of the company they own, but not both)

• New board would include myself and Sarah (our COO), Michelle (from Ignition, who’s been on our board since 2007) & Neil plus a new, outside member to be approved by all parties

• The CEO could only be replaced if ALL board members unanimously approved the new person

• A sale of the company for less than a 3X return to Neil’s firm could be vetoed by them

• All other terms very similar to our Series A deal

We felt really good around these terms, and although we recognized we likely could have gotten a higher pre-money valuation through a more intensive process, we decided not to take that path, reasoning that delay could cause a dip in the markets, and that we needed to concentrate on the business, not spend more time on fundraising.

On August 5th, we executed and entered a 30-day due diligence phase.

Then Things Got a Little Weird

Michelle was the first to note that something was “odd.” In a phone call with Neil, she heard him comment that they “needed to do more digging into the market.” In her opinion, this was very peculiar, as investors typically have a thesis and great quantities of diligence long before talking to companies, nevermind prior to a signed agreement. In fact, when Neil approached us, it had been under the auspices of excitement about the SEO/inbound marketing field. One of the things we liked best about them had been their strong belief, passion and knowledge about the SEO landscape. Questions about “market size” and “opportunity” at this stage seemed peculiar.

I shot Neil an email noting that we were a bit concerned. Here’s his reply:

We didn’t actually chat that night, but a few days later. On the call, he strongly disabused me of the idea that they’d pull out, noting that they had invested massive time and energy, multiple trips to Seattle, multiple people from their firm, considerable research and expense. One of the most memorable quotes from that conversation that stands out in my mind was “We never pull out after signing an LOI unless we find fraud or some other serious misrepresentation of what we already know.”

We set up a lunch date for the next week on a Friday, just prior to their planned, in-person diligence with our team the following Monday/Tuesday (when their legal, accounting and tech folks would be meeting with teams and execs to make sure all was in order).

One other item Neil mentioned in the call was our July numbers – we’d just closed out the month and sent them details a couple days prior. Neil noted that they were curious about why July’s revenue was off budget by ~$70K. I promised to follow up and provide details.

For reference, here’s our revenue numbers from January to July of 2011:

In December, our draft budget had us doing approximately $15K more in revenue in June and $70K more in revenue (both product – our only services revenue is events like Mozcon). However, we’d beaten revenue estimates from January – May and thus, were still ahead of our total revenue target by ~$35K for the year.

Nonetheless, given that June and July were slightly slower in growth of new PRO members (we grew approx. 7% in July vs. our projected 10%), Sarah revised our rolling forecast for the year, projecting that rather than hit $12.4mm (our previous rolling forecast given our higher-than-expected growth Jan-May), we’d instead be around $11.2mm unless growth in future months picked up again. Our model for the rolling forecast is fairly standard and fluctuations like this are fairly common. At one point earlier this year, the rolling forecast had us projecting nearly $14mm, and as low as $11mm.

We didn’t worry much about these numbers – for the past 4 years running SEOmoz, we’ve often see months that beat our targets and some that don’t. Certainly, a month where we expected 10% growth but only hit 7% was nothing shocking, particularly in a year where, even with the revised estimate, we’d be doubling revenue from 2010 (in which we did $5.7mm).

Unfortunately, our new would-be-investors didn’t see things that way. Well… Maybe.

The following week (Tuesday, August 16th), VentureBeat wrote a story that SEOmoz had closed a $25mm funding. I quickly commented on the story and called the reporter. They fixed the piece a few hours later:

I also got on the phone with Neil, but he didn’t seem overly concerned about the misinformation or the story. As far as I know, no one at Moz was responsible, and the misinformation made this seem incredibly unlikely. Given the numerous inaccuracies (our employee count, customer numbers, the description of what we do and more), I really have no idea who their source was, or why they published this piece without waiting for our confirmation or statement.

We went back to work on the diligence documents and preparation, a bit shaken and more than a little skeptical.

Two days later, the day before Neil and I were to meet for lunch, he sent an email indicating they were cancelling their in-person diligence in Seattle (planned for the following Monday/Tuesday) pending our meeting. I immediately assumed they were killing the deal, and emailed the Moz team to stop the work for the process on our end.

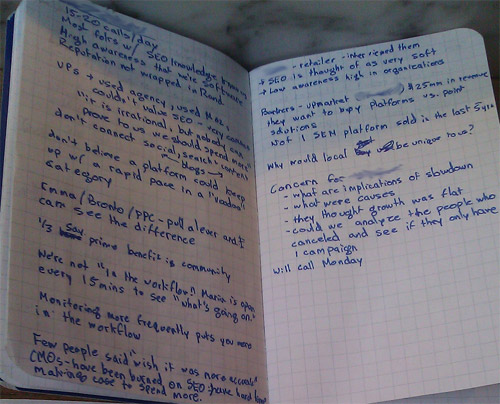

We met in New York and had lunch. I took notes:

I thought they were going to focus primarily on the growth we missed in July – despite knowing that it wasn’t a big deal from the long-term perspective of the business, it was nerve-wracking and hard-to-shake in those few days. But instead, we talked for nearly 2.5 hours about our market strategy, how we planned to expand our product, deliver more value, etc. Neil shared a lot of what they’d learned talking to CMOs, VPs of Marketing and SEO specialists at companies they knew. It was all pretty flattering, actually – I was shocked at how positive the feedback had been.

The only big concern he brought up from that research was that higher-up marketing executives still lack belief in SEO. One quote that I noted above was a VP who said “I know it’s irrational, but nobody can prove to me that we should spend more.” This lack of investment in SEO and inbound marketing compared to paid channels, despite the higher ROI and lower acquisition cost, is something every inbound professional fights against.

At the tail end of the conversation, Neil brought up their concerns around our July numbers. They asked whether we felt the month was “a blip or a softening of the market.” I explained that when we looked into it, we saw a few major drivers:

• June/July lacked major new product releases/improvements as we geared up for MozCon at the end of the month (where we had three big releases, including the new OpenSiteExplorer, one of our flagship products)

• We had turned off re-targeting ads for SEOmoz and OSE in late June as we switched providers and didn’t have it on again until early August. Re-targeting’s great for us, because we have such high organic traffic, and it brings those visitors back. Based on the May/June numbers, we likely lost between 5-10% of new memberships from this alone.

• May, June and July also didn’t feature as many upgrades and improvements to our performance marketing channels, primarily because we focused the team’s time on other projects, including, notably, calls, metrics requests and data dives related to fund raising.

• We put more attention and effort than intended on events – Mozcon and our Mozcations – and less on our funnel. We were definitely feeling a bit cocky thanks to our better-than-expected January-May.

• The team was distracted by fundraising. I actually didn’t use this explanation when talking to Neil (I think I felt ashamed of bringing it up – that it would make us look worse than the others), but it certainly played a part.

I also told Neil that, if it was very important to them, we could certainly hit the $12.4mm revenue target for the end of the year by focusing on short-term acquisition, but that it would come at the expense of longer-term projects, and we felt that was unwise and unwarranted.

The meeting wrapped up, and Neil promised me an update by Monday. Tuesday morning we got the call; no deal. They released us from the term sheet conditions including, generously, the associated NDA. I promised that in the blog post I’d write (the one you’re reading now), we’d keep their identity anonymous, “Dragnet-style.”

Why Did The Deal Fall Apart?

We have a few working theories, but don’t know for sure.

• What Neil Told Us – according to Neil, the sole reason for their exit was the softness in the June/July numbers. However, this is very hard for me to swallow. We literally missed growth in two months where we had a combined $1.8mm in revenue by $85K, and we were still technically ahead on the revenue projections for the year (by $35K).

• The VentureBeat Theory – one guess is that someone important and trusted by Neil contacted him following the VentureBeat story and advised them not to put money into us for one reason or another. This fits the timeline reasonably well, but they did seem nervous about the deal even prior to the story coming out.

• Market Timing – as anyone who follows the stock market knows, the beginning of August was a rocky period. It appears to have stabilized more recently, but it could certainly be that, as in 2008 when funding suddenly dried up, the market’s crashes took their toll on Neil’s confidence or that of their firm’s LPs (who said something like “don’t make a capital call right now.”)

• Something in the Research – it’s also possible that something they found during their diligence into the market spooked them, but they couldn’t or wouldn’t share it with us. It’s hard to imagine what it could be, or why they wouldn’t tell us, but I suppose anything’s possible.

I doubt we’ll ever know for sure, and that’s pretty frustrating. Last week, I sent the team this email:

The replies back were awesome. I won’t share them here, but they killed whatever doubts I might have harbored from Neil’s withdrawal. Working at SEOmoz just flat out rocks, and it’s because I’m surrounded by some of the best people ever to be assembled. Re-reading those emails now still brings an unmitigated smile to my face.

What Did We Learn? What Lessons Can Others Take Away?

The lessons from this process are challenging to compile, not only because it was such an inbound process, but because so much of the reasons for the final result are unknown. Nonetheless, I’ll try:

• Don’t Let Fundraising Distract You from What Really Matters – If I had this to do over again, a big part of me would still want to have the slower-than-expected growth in July to make sure we didn’t get a fairweather friend who didn’t really believe in the company onto the board, but I also know we could have been much more disciplined. Spending the team’s time not just on phone calls and webinars to walk investors through our numbers, but time researching, pulling metrics, re-inforcing market questions, etc. was a waste. We should have let the investors do more of the work and kept the team more focused on the mission at hand. If an investor really wants to be part of Moz, a few missing, non-standard business metrics aren’t going to change that.

• Inbound Interest is No Guarantee of Getting Funded – For some reason, I had this idea stuck in my head that if the company is being pitched to take funding by investors, the deal will be dramatically easier to do. This might be true, but “easier” doesn’t mean “in the bag.” Our first round did work largely this way – Michelle and Kelly pitched us, we said yes, money arrived. This time, Neil, Reggie, Todd and plenty of other reached out to us, pitched and at the end of the process, nada.

• Be Careful About How & Where Funding is Communicated – We tried to be cautious this time around, not wanting to get our team or ourselves too excited before money was in the bank. Nevertheless, we definitely started planning ahead a bit prematurely. The nights and weekends (and a few days, too) spent brainstorming and roadmapping an SEOmoz with another $18mm in cash was time we certainly could have spent on more productive, realistic goals.

• Be Excellent to Everyone, All the Time – I can definitely confirm that the world of venture capital and private/growth equity is a very tiny one, and that entrepreneurs, partners and service providers talk incessantly and vociferously about nearly every experience with an investor or company. If you’re in the startup world on any side of that equation, it pays to be a great human being and to treat everyone with respect (this is probably another full post worth writing at some point). We heard some not-so-great things about several potential investors, and it made us pull back pretty quickly. Folks in the Valley often talk about how “reputation is everything,” and this experience re-inforced that for me.

• Never, Ever Get Cocky – I have to admit that sometime around the end of June/beginning of July, I was starting to feel pretty good. A bunch of investors wanted to put a LOT of money into our company. We were beating revenue month after month. We turned away investors instead of the other way around. I tried to stay humble, stay hungry and not get overly excited about things, but the idea of having liquidity for my family, the ability to grow Moz in a new and exciting way and, yeah, the idea of finally having some personal savings were all dancing in my head.

• Remember What Really Matters – No matter how this VC story went, I’m an incredibly lucky member of the human race. The big stuff is going amazingly well. My grandmother, who had a fall back in May, has almost entirely recovered. I’m surrounded by people I love to work with, all of whom are excited to come into the office every day, investment or no. And I’m married to her:

Our Plans Going Forward

The best part about this otherwise frustrating result is that we didn’t end up signing a deal with a firm who didn’t truly believe in us, our market or our future. Despite our positive experiences with Neil from March – July, the last couple weeks clearly showed that he would have been a poor choice for our board of directors. Whatever caused the cold feet, it’s better now than after the investment, when a wrong choice could have made life unpleasant for everyone for many years to come.

On the investment front – we’ve decided that attempting to raise a round of funding anytime in the next 6 months would be a mistake. We continue to receive calls from potential investors, but my message has shifted to “let’s maybe talk again next year.”

Personally, I feel burned. This is the second time in 3 years that I’ve gotten excited about raising a potential round of capital, and it turned out terribly both times. I’m not sure what I did wrong or what I should do differently next time. I also don’t know how we could have done more diligence on Neil or his firm – literally everyone we talked to raved about him; even the skeptical third-parties who went digging into their mutual contacts for us had great things to say.

Phone calls and meetings are one thing, but this wasted a massive chunk of our time, energy and emotion. Putting faith in the process in the future would be hard – if a deal can fall through this late, when we weren’t even pitching but got pitched… Well, I just don’t know. Everything about this feels wrong.

What I can say is that this experience makes me and the rest of the Moz team even more inspired and motivated to build an amazing company. We can’t help but feel passion for proving doubters and naysayers wrong. The greatest revenge is to execute like hell, bootstrap all the way, and do what we said we’d do – become Seattle’s next billion-dollar startup, and make the world of marketing a better place.

I know we can do it.

p.s. A huge thank you to so many amazing people who helped us out with their advice, networks and reviews during this period – Mark Suster, Hugh Crean, Brian Halligan, Michelle Goldberg, Dharmesh Shah, Gautam Godhwani, Jason Cohen, Nirav Tolia, Kelly Smith, Dan Shapiro, Ben Huh – and many, many more. You were the best parts of this experience, and I hope I can repay the favor somehow in the future.

UPDATE: Things eventually worked out well 🙂